Uncategorized

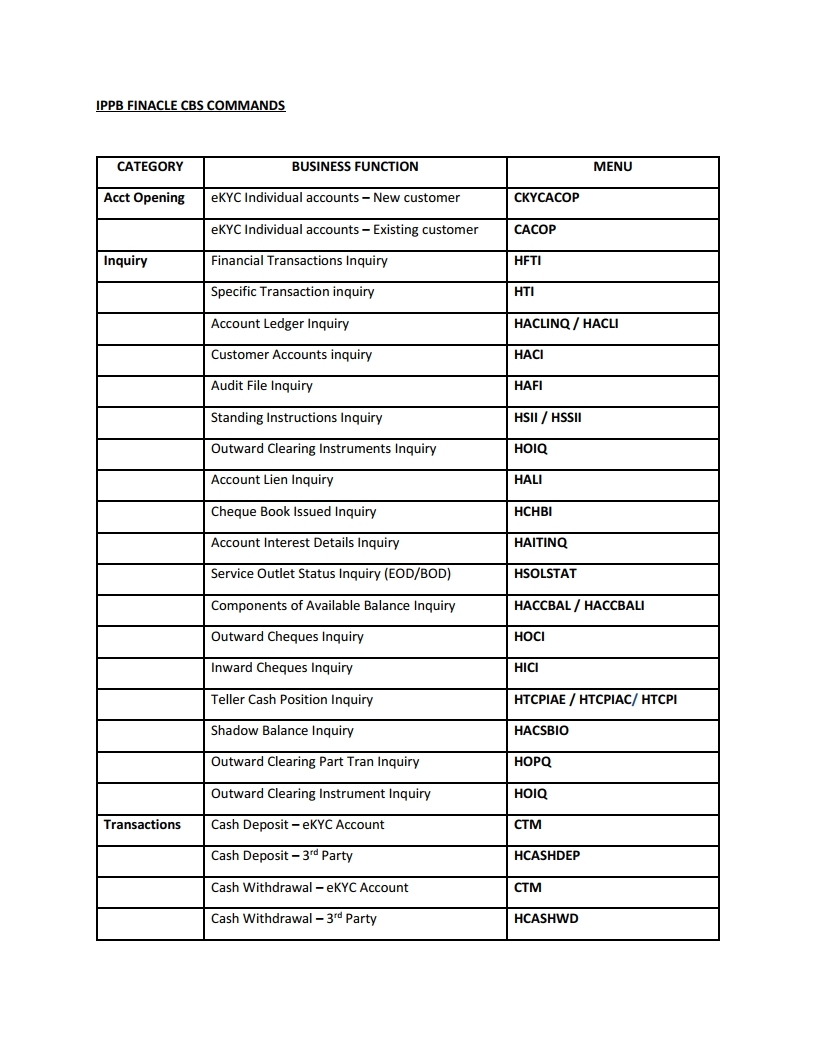

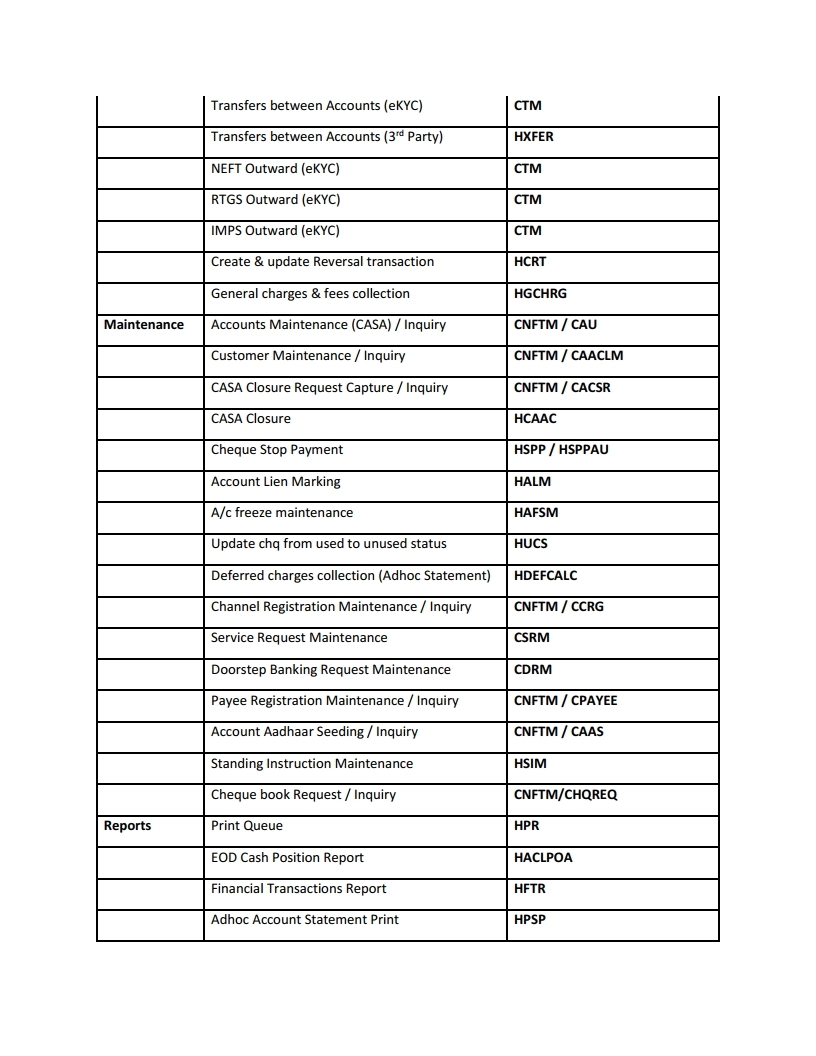

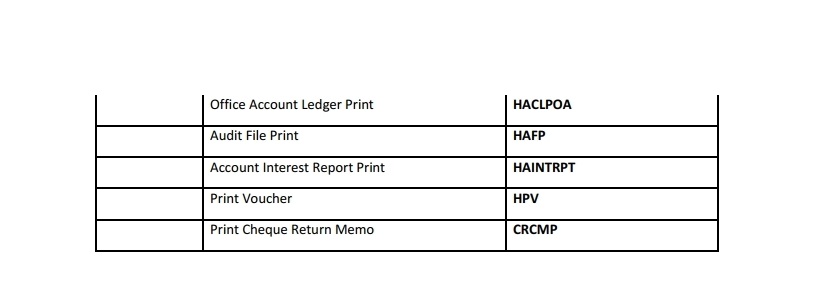

Forms Name and Material Number in CSI

UncategorizedBANK RECONCILIATION MADE EASY [CSI]

UncategorizedFirst note down House bank I’d and Bank key

FCHI

- House bank- click searcher

- Remove filter 500 and list

- Searcher – key in bank name

- (Note down for each bank)

FCHI

View red ink item (unadjusted item)

FAGLL03

- GL (Bank Drawings / Bank remittance for the state)

- Posting date (Select From and To as Last month)

- Custom selections : Year & PC

- F8(Copy it in Excel)

FAGLL03

Scroll Entry by schedule PA

FF67

- (Varient – DOPI , Type – 4)

- Bank key (Available from FCHI)

- Bank ac no (Available on PM Cheque)

- Currency : INR

- Statement no – (Scroll number)

- Statement date – current date

- Bank posting only – Tick

- Press three times

FF67

Trans : DP01 (For Remittance)

DP02 (For Drawings)

Profit center

Bank Ref : Chq No. For drawings

(Assignment in FAGLL03)

: Doc. No. For Remittance

(Doc. No in FAGLL03)

Amount : Amt

(Prefix minus symbol for drawings)

Doc. date : PO accounting date

Value date : scroll date

( Enter all row entries like this )

click GOTO – Change controls

(Press enter as many times as the number of row entries)

Finally, OB/CB screen will be displayed.

Opening balance : 0

Closing balance : Total amt.

(Prefix minus sign before the Total

Amt. in case of Drawings)

Click Tick

Click Tick

(Entered Amt & Bank Amt are tallied)

Save

Save

(A table of entries in Yellow colour will be displayed)

Verify the reconciliation by APM accounts

FEBAN

DOPI

House bank : (Available from FCHI)

Account I’d : click searcher

R00001 (For Remittance)

D00001 (For Drawings)

- Execute

- Click arrow in front of House bank

- (The scroll entries will be listed down)

- Select the red entry

- Post

FEBAN

(Drawings will be adjusted then and there)

For Remittance :

Click document

Enter doc no in From & To

Post

(Do these for each entry)

(The entries in FEBAN screen will be Green.)

- Check in FAGLL03 and verify the entries are Green now. Note that Clearing document column are filled with document numbers. Export to Excel.

View the reconciliation report

Zfi_Recon

(Dont worry .This won’t work..!!)

So FAGLL03 Report is enough.

Note 1 : The reconciled amount will appear in the DAC of that profit center on both Receipts and Payments under Bank reconcile GL for drawings and Remittance.

Note 2 : The cheques from BNPL customers received as monthly bill will have to be adjusted like this in Bank reconciliation process so as to get accounted in the respective customer’s account

Zfi_Recon

So FAGLL03 Report is enough.

How to Add Post Master’s New Cheque Book to the Cheque lot in CSI Post Office?

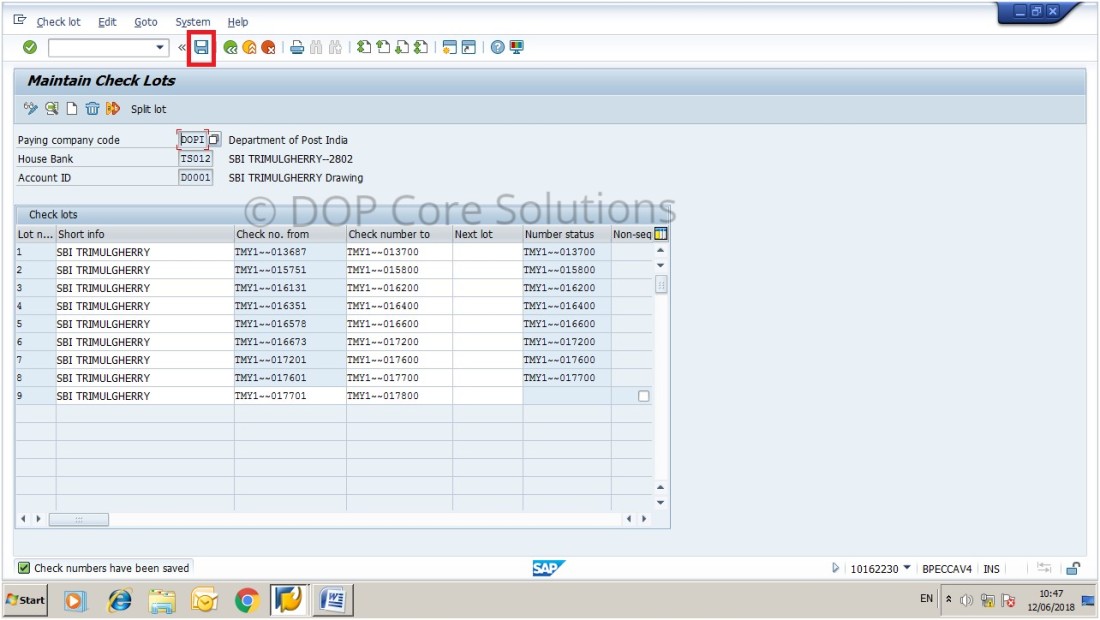

Uncategorized1. Go to transaction FCHI. Enter the below details.

| Company code | DOPI |

| House Bank | Bank number |

| Account Id | D0001 |

2. Click on the Change(Pencil Icon) button as shown in the below screenshot.

3. Now click on the New button as shown in below screenshot

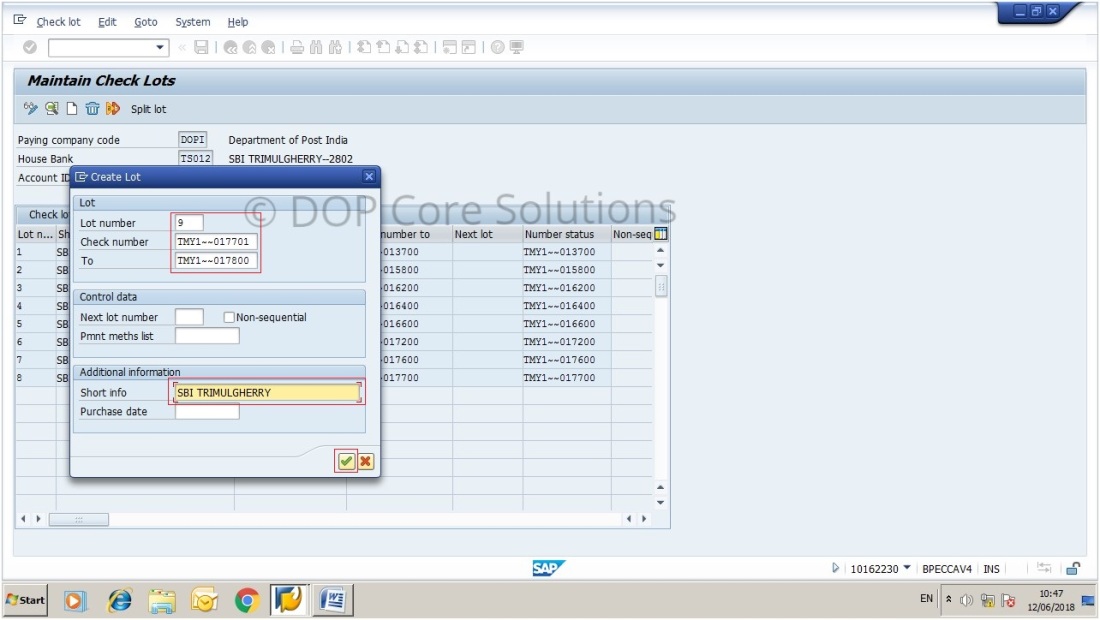

4. Now a new popup window will open as shown in the below screenshot.

Enter the below details

| Lot number | If you using the second checkbook then, it should be 2 and so on. |

| Check number | Starting number of the cheque book. |

| To | Ending number of the cheque book. |

| Short Info | Your Bank Name |

SB Order No. 07/2018 : Deduction of TDS in respect of Senior Citizens who have invested in Sr. Citizen Savings Scheme regarding

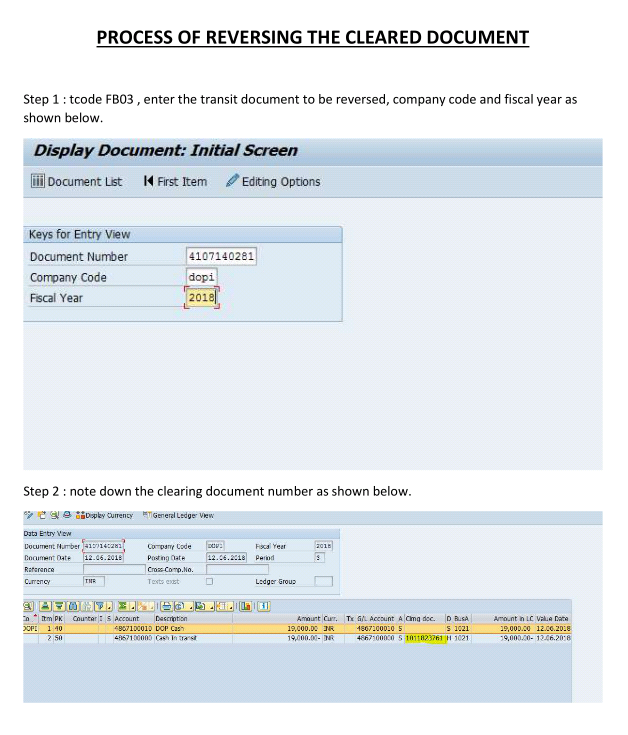

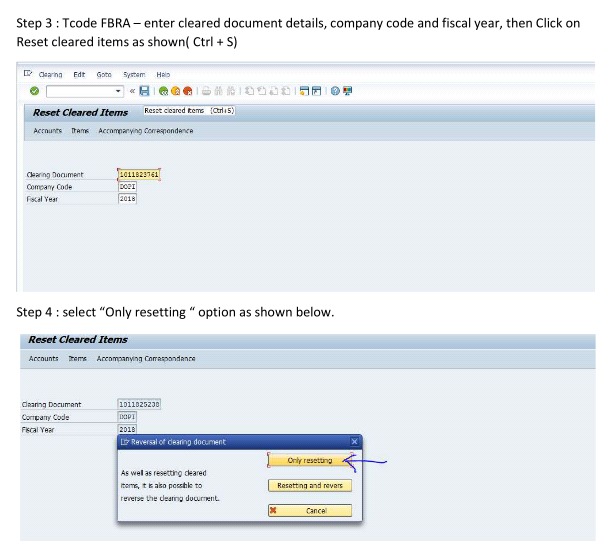

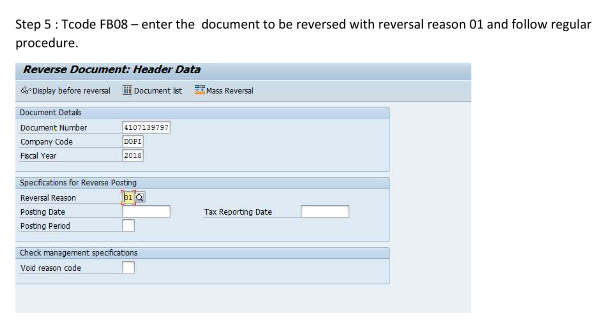

UncategorizedProcess of Reversing The Cleared Document in SAP – CSI

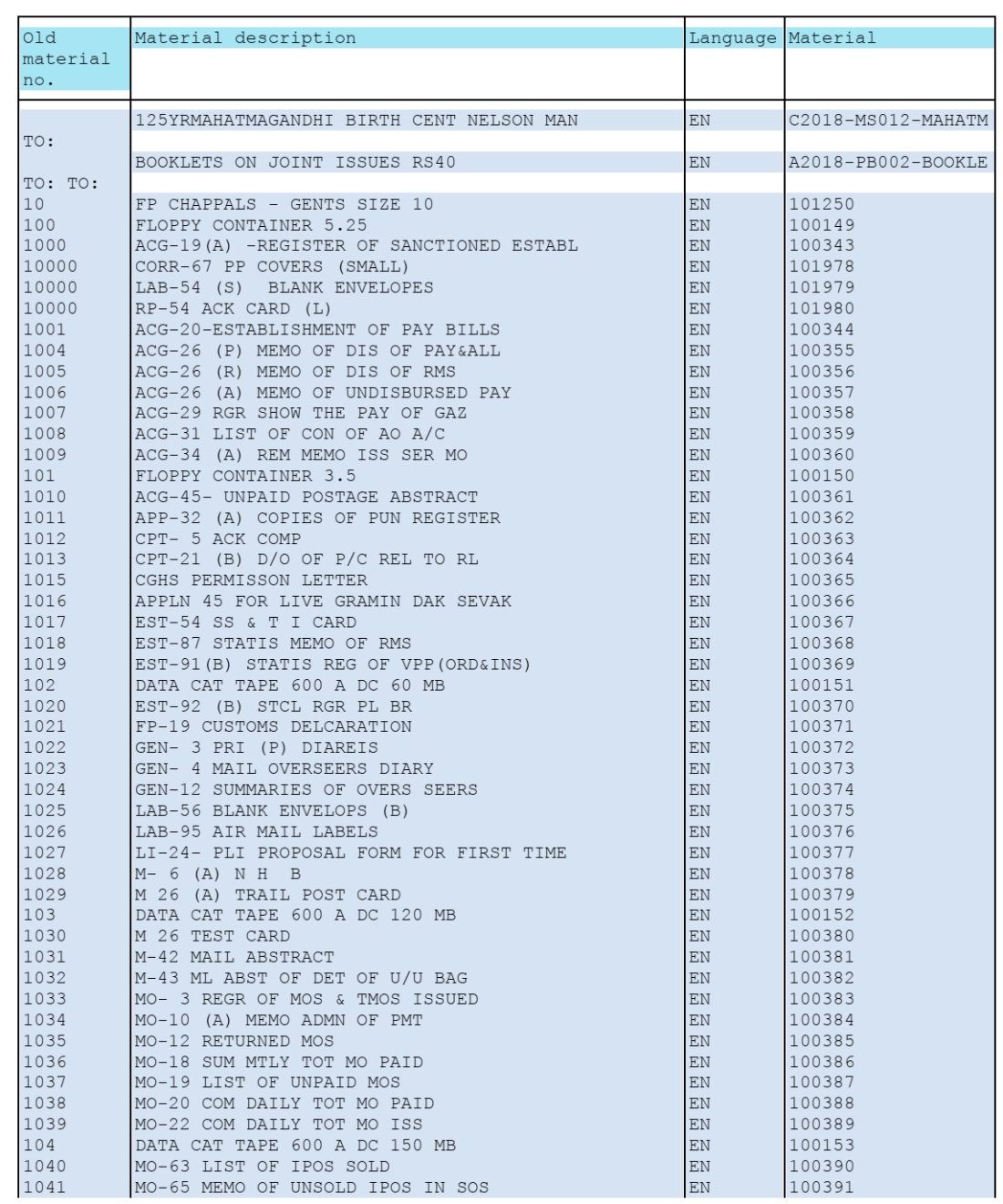

UncategorizedHow to check opening and closing balance of Postage Stamps/Revenue Stamps/Any Stock material in SAP – CSI

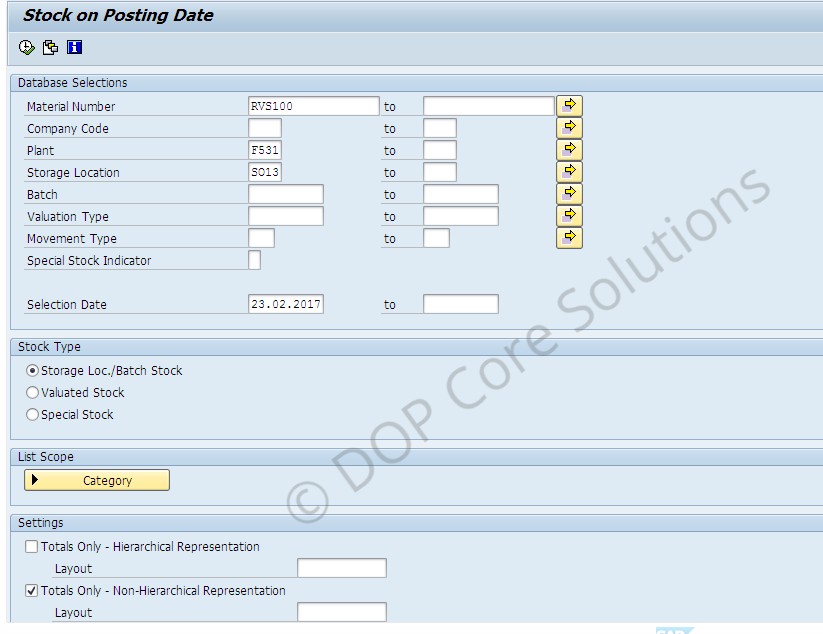

Uncategorized1. Go to Transaction MB5B

2. Below screen appears. Now enter the plant, Storage location combination for your office and the material whose stock you want to check, Selection date for which you want to see stocks and execute.

3. The radio button Storage Loc./Batch Stock should be selected

2. Below screen appears. Now enter the plant, Storage location combination for your office and the material whose stock you want to check, Selection date for which you want to see stocks and execute.

3. The radio button Storage Loc./Batch Stock should be selected

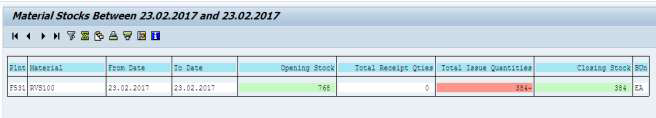

4. This is a sample view of the executed report

It shows opening stock, quantity of stock received/issued and closing stock

Tcodes for verifying open balances data in SAP

Uncategorized1. Material balance- MB51/MB52

2. Account receivable data – FD03

3. Account payables data- FK03

4. General ledger balance- ZRFBL3N or FAGLL03 ( G/L code :4867100010)

5. budget balance- ZFMRP_RW_BUDCON

6.Customer Advance- ZADVANCE_DEPOSIT

7.Customer booking- FBL5N

8.FCHI – unused PM cheque..

9.To check leave balances t-code :ZHR_EMPDETAILS

10. IPO – IQ09

Tcode for Cheque Transactions in CSI

UncategorizedFCH3: Void unnused cheques (cheques not issued)

FCH9: Void issued cheque (cheque must be created, does not reverse payment)

FCHE: Delete information on voided cheque (cheque must be voided)

FCHD: Delete cheque information created from payment run (cheques created from F110 or F-58)

FCHF: Delete cheque information created manually (cheques created from FCH5)

FCHG: Resets specific information from cheque (voided reason, cashed data or extract data)

FCH8: Reverse payment document from cheque